Paul B Insurance Fundamentals Explained

Wiki Article

Paul B Insurance Fundamentals Explained

Table of ContentsThe Ultimate Guide To Paul B InsuranceThe Definitive Guide for Paul B Insurance10 Simple Techniques For Paul B InsuranceAll About Paul B InsuranceSee This Report on Paul B InsuranceSome Known Details About Paul B Insurance

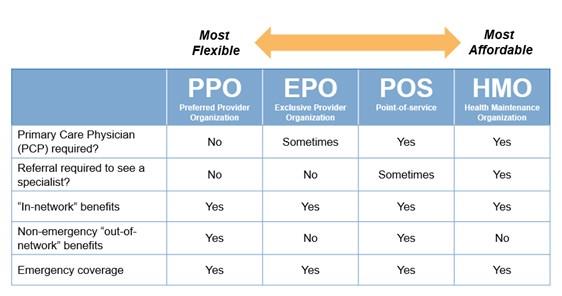

An HMO might require you to live or operate in its service area to be qualified for protection. HMOs typically give incorporated care and also concentrate on prevention and health. A sort of strategy where you pay much less if you make use of physicians, medical facilities, as well as other wellness care suppliers that come from the plan's network.

A kind of wellness plan where you pay much less if you utilize suppliers in the plan's network. You can utilize medical professionals, medical facilities, as well as companies beyond the network without a referral for an additional cost.

, and platinum. Bronze strategies have the least insurance coverage, as well as platinum plans have the many.

If you see a medical professional who is not in the network, you'll might have to pay the complete expense on your own. This is the expense you pay each month for insurance.

Paul B Insurance - An Overview

A copay is a flat fee, such as $15, that you pay when you get care. These fees differ according to your plan and they are counted towards your deductible.Higher out-of-pocket costs if you see out-of-network physicians vs. in-network companies, More documentation than with other plans if you see out-of-network providers Any type of in the PPO's network; you can see out-of-network doctors, but you'll pay even more. This is the cost you pay monthly for insurance coverage. Some PPOs might have a deductible.

A copay is a flat fee, such as $15, that you pay when you obtain treatment. Coinsurance is when you pay a percent of the fees for treatment, for example 20%. If your out-of-network doctor bills even more than others in the location do, you might need to pay the balance after your insurance policy pays its share.

Lower costs than a PPO provided by the very same insurance company, Any in the EPO's network; there is no protection for out-of-network suppliers. This is the cost you pay monthly for insurance. Some EPOs might have a deductible. A copay is a flat fee, such as $15, that you pay when you get treatment.

Paul B Insurance Can Be Fun For Anyone

This is the price you pay monthly for insurance policy. Your strategy might require you to pay the quantity of a deductible before it covers treatment past precautionary services. You might pay a higher deductible if you see an out-of-network provider. You will certainly pay either a copay, such as $15, when you get treatment or coinsurance, which is a percent of the costs for care.We can not protect against the unforeseen from taking place, however often we can protect ourselves and our households from the worst of the monetary after effects. Picking the ideal kind and also quantity of insurance coverage is based on your specific situation, such as children, age, way of living, and also employment advantages. Four sorts of insurance policy that the majority of economists advise include life, health, car, and long-lasting impairment.

It includes a death advantage and also a cash money worth part.

2% of the American population was without insurance policy protection in 2021, the Centers for Disease Control (CDC) reported in its National Center for Wellness Stats. Greater than 60% got their coverage through an employer or in the personal insurance marketplace while the remainder were covered by government-subsidized programs consisting of Medicare as well as Medicaid, experts' benefits programs, as well as the federal marketplace established under the Affordable Care Act.

The Ultimate Guide To Paul B Insurance

Investopedia/ Jake Shi Lasting impairment insurance coverage supports those who come to be unable to function. According to the Social Safety Administration, one in four employees entering the workforce will certainly become disabled before they get to the age of retirement. While health and wellness insurance coverage spends for hospitalization and also medical costs, you are commonly strained with all of the costs that your income had actually covered.Practically all states require motorists to have vehicle insurance policy as well as the couple of that do not still hold vehicle drivers monetarily liable for any damages or injuries they create. Right here are your choices when buying auto insurance coverage: Responsibility coverage: Pays for property damages and injuries you trigger to others if you're at mistake for a mishap as well as likewise covers lawsuits prices and also judgments or negotiations if you're sued due to a car accident.

Company protection is typically the very best option, but if that is unavailable, obtain quotes from numerous companies as numerous supply discount rates if you buy more than one type of insurance coverage.

The smart Trick of Paul B Insurance That Nobody is Discussing

When comparing plans, there are a couple of elements you'll desire to take anonymous into consideration: network, price and benefits. Check out each plan's network as well as determine if your preferred service providers are in-network. If your medical professional is not in-network with a strategy you are taking into consideration however you intend to continue to see them, you may want to think about a different plan.Search for the one that has the most advantages and any kind of specific doctors you need. A lot of companies have open registration in the loss of yearly. Open enrollment is when you can change your advantage options. You can transform wellness plans if your company supplies even more than one strategy.

You will certainly need to pay the costs on your own. ; it may set you back much less than specific health and wellness insurance coverage, which is insurance coverage that you get on your very own, and the advantages may be better. If you receive Federal COBRA or Cal-COBRA, you can not be refuted protection since of a medical problem.

Continue

Paul B Insurance Can Be Fun For Everyone

Some HMOs offer a POS strategy. Fee-for-Service plans are frequently believed of as typical strategies.Report this wiki page